Business Finance Solutions

Kastali offers a variety of financing solutions for your business. Our investors & lending partners provide business-to-business working capital solutions that are customizable, flexible, and adaptable to fit a wide variety of needs.

The flexibility of having several resources for most types of business funding allows us to easily work with your business, finding a solution that fits your current situation.

Our lending options include:

- Business Line of Credit

- Machinery / Equipment Financing

- Term Loans

- Start-Up Funding

- Working Capital

- Acquisition Funding

- Expansion Financing

- SBA 7(a) Loans (non-real estate based)

- SBA 504 Loans (Real Estate Only)

Kastali’s financing partners offer creative and flexible working capital solutions for several B-to-B business types including but not limited to:

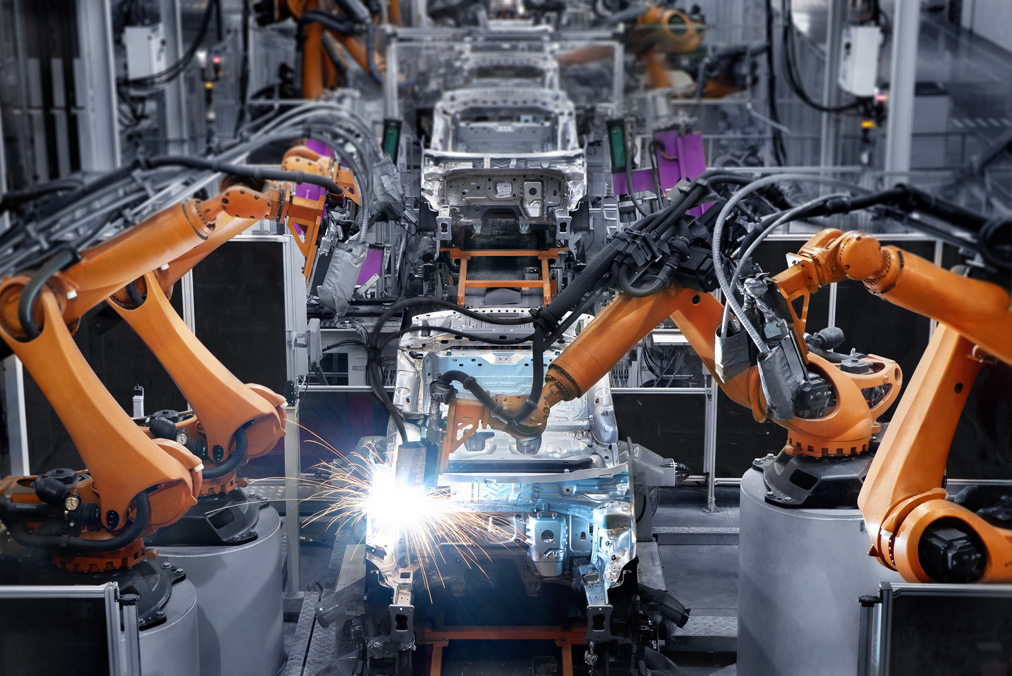

- Manufacturing

- Medical Receivables

- Renewable Energy

- Automotive Suppliers

- Apparel and Footwear

- Home Furnishings

- Staffing

- Promotional Material Marketing Companies

- Transportation

- Government Receivables

- Oil and Gas Well Services

- Importers / Exporters

- Furniture Manufacturers

- Insurance Agencies

- Hospitality / Hotels

- Food Manufacturing/Distribution

- Aggregate Suppliers

- Book Publishers

- Printers

- Construction/Development

- Commercial Door Service/Repair

- Metal Fabricators

- Store Display Manufacturers

- Distribution & many more

Kastali’s trusted network of capital providers deliver timely and flexible working capital to help you with:

- Expansion – Acquisition – Growth

- Take advantage of supplier discounts through better payment terms

- Restructuring – Refinancing

- Purchase Larger Quantities

- Turnarounds – Recapitalization

- Receive Payments Quicker

Typical Issues or Opportunities:

- Working capital tension due to inadequate credit from banks and suppliers

- Immediate opportunity with a product, customer, project or market share

- Losing sales and missing sales opportunities

- Backlog of orders or jobs

- Typically, marginally profitable or losing money

- Might have a challenged balance sheet reflecting a negative net worth

- Going through or coming out of a bankruptcy

Typical clients are:

- Service providers, manufacturers or wholesale distributors

- Located in the USA

- Need asset-based financing from $250,000 – $30M+

- Continuously have commercial accounts receivable.

- Usually have inventory and machinery or equipment.

- In asset recovery with a bank or on an “exit” strategy.

- Earn a gross margin of 20% or more.

- Have trade cycle from 60-150+ days.

- Annual sales from $1 million to $50 million.

- Have solid relationships with their suppliers and customers.

- Provider services or sells finished goods to creditworthy buyers.

Our lending options include:

Kastali offers may options but focuses on these three different types of business lines of credit.

Accounts Receivable Financing or Ledgered Line of Credit

This type of funding is secured by accounts receivable/invoices. Simply submit your invoices to our funding partner as you issue invoices to your customer, funding is based on each separate invoice. Because funding isn’t done in batches, your able to create a solution that work with most business types, even start-ups.

Because line of credit advances are based on invoices submitted, this creates a flexible funding source for active companies looking to fund sales growth. A major advantage to this type of financing is that it utilizes the value of your existing receivables to support additional financing for your company.

Recourse Invoice Factoring

This offers flexible financing in a role very similarly to a line of credit, but not technically considered one. Your funding facility is based on accounts receivable/invoices that are purchased at a discount to provide immediate capital availability for your company. This form of financing is useful in specialized industries, to provide funding for start-up companies, and companies in extreme transition.

Companies of various sizes at any point in their growth and development cycle can obtain working capital to grow from your established base, our capital providers stand ready to help you meet your working capital needs with a business line of credit.

Asset-Based Line of Credit

Asset-based lines of credit typically are secured by Accounts Receivable and/or with Inventory. When executing this plan, you submit a batch of invoices or furnish a list of your inventory to your lending partner and are funded based on a fixed formula for those invoices or inventory that make up the batch. This credit facility is flexible and well-matched to companies whose balance sheets are stable and when growth is projected.

If your in need of additional working capital, a business line of credit could provide the funding you need. Kastali’s numerous business lending partners have the financing solution to best fit for your current business situation.

Contact us today!

| Min Structure: | 5,000,000 – 75,000,000 |

| Sector Type: | Oil & Gas |

| Facility Purpose: | Upstream Capital |

| EBITDA | |

| Equity: | |

| Enterprise Value: | |

| Sales: | |

| Recourse: | Non-Recourse Available |

| Broker Fees: | From 2-3% depending on market, size, timing, and complexity |

| Lender Due Diligence Retainer: | $2,500 to $5,500 or larger on complex -or- high balance loans |

| Packaging & Processing Fee: | Typically $795 – Refundable at closing |

| Locations: | Continental US **Rural & Offshore Case by Case** |

| Projects of Interest: | Mid-Stream |

| Focus is in hard-asset businesses, including gathering and transportation pipelines, treating and compression assets and services, processing and fractionation plants, storage and terminalling facilities, logistics handling and disposal facilities, and other such assets or companies providing similar services. | |

| Pipelines, gathering, processing | |

| Shipping, storage, fabrication | |

| Refining and petrochemical | |

| Process and transport hydrocarbons from center of supply to center of demand | |

| Up-Stream | |

| value-added source of growth equity capital | |

| Desired Charactoristics: | Experienced management team with track record of operating success |

| Assets located onshore in the continental United States within basins with existing infrastructure | |

| Assets are currently producing, have established producing histories, and positive field level cash flow | |

| Assets are predominantly operated; non-operated interests can be pursued for follow-on acquisition | |

| Commodity agnostic, but prefer a mix of oil, gas, & NGLs | |

| PDP upside through operational enhancements and cost reductions | |

| Inventory of low-risk and low-cost development opportunities including PDNP and PUD reserves | |

| Control equity with customary minority protections for other investors, and competitive incentives for management teams |

Machinery / Equipment Financing

Is your need for new machinery and equipment slowing down production and stunting the business growth of your company?

Kastali’s financing partners understand as your business grows, equipment and machinery can become an immediate need. We can help manufacturers and distributors keep their companies running smoothly with lucrative financing options for the purchase of equipment, or by using equity in existing equipment you already own to access the necessary working capital.

We offer several machinery / equipment financing options:

SBA 7(a) machinery and equipment loans

For qualified borrowers looking for a working capital line of credit. Provides up to 10 year amortization.

Equipment Loans

Primarily relies on your collateral’s valuation; no requirement for a working capital line of credit for eligibility for this machinery and equipment lending product.

Equipment Leasing

Fair market value leasing financing for new and used equipment on a stand-alone basis.

Equipment Term Loans

Our lending partners specialize in equipment term loans for industrial manufacturing machinery and equipment. with the daily valuation and disposition of industrial assets it allows them greater ability to capitalize on the values within complete plants and facilities.

Term Solutions are structured for financing complete facilities, and are ideal for:

- Plant Expansion & Start-ups

- Product Expansion & Business Growth

- Management/Partner Buy Outs

- Reorganizing of the Business

- Strengthening of Credit Position

- Unlocking Equity from Existing Equipment

- Companies No Longer Meeting Lending Criteria of Banks

As a broker with access to the top ABL lenders it allows us to bridge the gap between the funds on hand, and the cash needed to finance your M & E essentials or meet demands for increased cash flow. If your company is at a standstill because of budget constraints, Kastali can source the best financing options to keep your business rolling.

Working capital is financing that keeps your business running from day to day.

It can vary according to workload, staffing needs, and other factors that change on a daily basis. No two businesses have the same working capital needs, for most companies a line of credit is the preferred option.

This type of working capital loan is often based on the company’s accounts receivable and is easily adjusted as your needs change.

Solutions That Work For You

We help source short-term working capital options including Asset-Based Lending, Accounts Receivable Financing, Factoring, and more. Because most working capital solutions are based on accounts receivable, you’re able to increase funding or cut it back as necessary to match your demands. Kastali works with businesses across a full spectrum of industries including; staffing, manufacturing, and transportation. Our finance partners understand the unique challenges facing many companies today, and will help create a plan that can grow with your company.

Adjustable to Meet Your Changing Needs

When working with Kastali for your working capital needs, you’ll receive a solution in sync with your working company and capital needs. Whether it’s the flexibility of accounts receivable funding, asset-based lending programs, or invoice factoring, we’ll help create a solution that fits your needs and business model.

Call us or complete a contact form today to learn more!

Start or expand your business with loans guaranteed by the Small Business Administration.

Our experienced team is dedicated to coaching you through all of your SBA loan options, SBA financing can provide you financing to fund opportunities such as growth, expansion, acquisition or restructuring, payroll, site improvements and more!

Start or expand your business with loans guaranteed by the Small Business Administration.

Our experienced team is dedicated to coaching you through all of your SBA loan options, SBA financing can provide you financing to fund opportunities such as growth, expansion, acquisition or restructuring, payroll, site improvements and more!

Lending Partner

Loan

Small Business (You)

Types of SBA loans we offer:

| Program | SBA Guarantee | Max Loan | Use of Funds | Maturity | Max Interest Rate | Guaranty Fees | Who Qualifies | Benefits to Borrowers |

| 7(a) Loans | 85% guaranty for loans of $150,000 or less; 75% guaranty for loans greater than $150,000 (up to $3.75 million maximum guaranty) | $5 million | Term Loan. Expansion/renovation; new construction, purchase land or buildings; purchase equipment, fixtures, lease-hold improvements; working capital; refinance debt for compelling reasons; season-al line of credit, inventory or starting a business | Depends on ability to repay. Generally, working capital & machinery & equipment (not to exceed life of equipment) is 5-10 years; real estate is 25 years. | Loans less than 7 years: $0 – $25,000 Prime + 4.25% $25,001 – $50,000 P + 3.25% Over $50,000 Prime + 2.25% Loans 7 years or longer: 0 – $25,000 Prime + 4.75% $25,001 – $50,000 P + 3.75% Over $50,000 Prime + 2.75% Fixed Rate: www.colsonservices.com |

Fees charged on guarantied portion of loan only. Multiple loans within 90 days may trigger additional fees. | Must be a for profit business & meet SBA size standards; show good character, credit, management, and ability to repay. Must be an eligible type of business. Prepayment penalty for loans with maturities of 15 years or more if prepaid during first 3 years. (5% year 1, 3% year 2, and 1% year 3) |

Long-term financing; Improved cash flow; Fixed maturity; No balloons; No prepayment penalty (under 15 years) |

| 504 Loans | 504 CDC maximum amount ranges from $5 million to $5.5 million, depending on type of business or project. Financed as follows: CDC: up to 40% Lender: 50% (Non-guaranteed) Equity: 10% plus additional 5% if new business and/or 5% if special use property. |

Project costs financed as follows: CDC: up to 40% Lender: 50% (Non-guaranteed) Equity: 10% plus additional 5% if new business and/or 5% if special use property. |

Long-term, fixed-asset loans; Lender (non-guaranteed) financing secured by first lien on project assets. CDC loan provided from SBA 100% guaranteed. Debenture sold to investors at fixed rate secured by 2nd lien. | CDC Loan: 10-, 20- or 25-year term fixed interest rate. Lender Loan: Unguaranteed financing may have a shorter term. May be fixed or adjustable interest rate |

Fixed rate on SBA 504 Loan established when the debenture backing loan is sold. Declining prepayment penalty for 1/2 of term. |

A participation fee of 0.5% is on lender share, plus CDC may charge up to 1.5% on their share. CDC charges a monthly servicing fee of 0.625%-2.0% on unpaid balance. Ongoing guaranty fee is 0.368% of principal outstanding. Ongoing fee % doesn’t change during term. | Alternative Size Standard: For-profit businesses that do not exceed $15 million in tangible net worth, and do not have an average two full fiscal year net income over $5 million. Owner Occupied 51% for existing or 60% for new construction. |

Low down payment – equity(10,15 or 20 percent) (The equity contribution may be borrowed as long as it is not from an SBA loan) Fees can be financed; SBA /CDC Portion: Long-term fixed rate Full amortization and No balloons |

| 504 Loan Refinancing Program Same as 504 Loan |

Loan to Value (LTV) Qualified and Secured Debt 90%. For projects that include “Business Operating Expenses (BOE)” the LTV is 85%. BOE may not exceed 15% of the fixed asset. | Same as 504 | At least 85% of the proceeds of the loan(s) to be refinanced had to be originally used for eligible fixed assets. May include the financing of eligible business expenses as part of the refinancing. | Same as 504 | Same as 504 | Same as 504 except, ongoing guaranty fee is 0.395% of principal outstanding. |

Loan(s) to be refinanced can’t be subject to a guaranty by a Federal Agency, can’t be a Third Party Loan which is part of an existing SBA 504 project and must have been current on all payments for the past 12 months. Both the business and loan(s) to be refinanced must be at least 2 years old. | Business can access equity in its commercial real estate for business operating expenses or refinance property on reasonable terms. Fees can be financed; SBA /CDC Portion: Long-term fixed rate Full amortization and No balloons |

| International Trade | 90% guaranty (up to $4.5 million maximum guaranty) | 5 million | Short-term, working-capital loans for exporters. May be transaction based or asset-based. Can also support standby letters of credit | Generally, one year or less, may go up to 3 years | No SBA maximum interest rate cap, but SBA monitors for reasonableness | Same as 7(a) Loans | Same as 7(a) Loans Plus, need short-term working capital for direct or indirect exporting. |

Additional working capital to increase export sales without disrupting domestic financing and business plan |

| Export Working Capital Program | 90% guaranty (up to $4.5 million maximum guaranty) | $5 million | Short-term, working-capital loans for exporters. May be transaction based or asset-based. Can also support standby letters of credit |

Generally one year or less, may go up to 3 years | No SBA maximum interest rate cap, but SBA monitors for reasonableness | Same as 7(a) Loans | Same as 7(a) Loans Plus, need short-term working capital for direct or indirect exporting. |

Additional working capital to increase export sales without disrupting domestic financing and business plan |

| CAP Lines: Working Capital Contract Seasonal Builders |

$5 million | Same as 7(a) Loans | Finance seasonal and/or short-term working capital needs; cost to perform; construction costs; advances against existing inventory and receivables; consolidation of short-term debts. May be revolving. | Up to 10 years, except Builder’s CAP Line, which is 5 years | Same as 7(a) Loans | Same as 7(a) Loans | Same as 7(a) Loans Plus, all lenders must execute Form 750 & 750B (short-term loans) |

1. Working Capital – (LOC) Revolving Line of Credit 2. Contract – can finance all costs (excluding profit). 3. Seasonal – Seasonal working capital needs. 4. Builder – Finances direct costs in building a commercial or residential structure |

Offering healthcare providers capital solutions that meet the needs of a complex environment.

The healthcare industry is one of the largest industries in the United States. Driven by an aging population, evolving technologies, and increased regulation, it is positioned for continued growth at an accelerated rate. In 2017 healthcare industry expenditures totaled $3.5 trillion; by 2026 expenditures are estimated to reach $5.7 trillion.1

This scale of growth commands an increasingly complex system for payment on services provided, Kastali’s Healthcare Financial services providers understand the difficulties associated with medical receivables and often provide the working capital and equipment financing healthcare providers may not be able to access through traditional sources.

Who we help:

- Physician Practices

- Regional Hospitals

- Skilled Nursing

- Medical Staffing

- Other Specialty

Our network of knowledgeable industry veterans understands HIPAA compliance and offer a range of financial solutions that can protect the ability to run your practice with:

- Asset-Based Lending

- Ledgered’ Lines of Credit

- Equipment Financing

| Min Structure: | 5,000,000 – 250,000,000 |

| Sector Type: | Healthcare |

| Facility Purpose: | Corporate Carve-Outs, |

| EBITDA | 1,000,000 – 250,000,000 + |

| Equity: | to 500,000,000 |

| Enterprise Value: | 200,000,000 to 2 Billion |

| Sales: | |

| Recourse: | Non-Recourse Available, Private Sale, Recapitalization, |

| Broker Fees: | From 2-3% depending on market, size, timing, and complexity |

| Lender Due Diligence Retainer: | $2,500 to $5,500 or larger on complex -or- high balance loans |

| Packaging & Processing Fee: | Typically $795 – Refundable at closing |

| Locations: | Continental US **Rural & Offshore Case by Case** |

| Projects of Interest: | Medical products, devices and instruments |

| Multi-site treatment centers | |

| Pharmaceutical manufacturing / pharmaceutical services | |

| Outsourced services | |

| Veterinary management companies | |

| Leveraged & Management Buyouts | |

| Recapitalizations | |

| Debt Refinancings | |

| Growth Financings | |

| Acquisition Financings | |

| Transitional Financings | |

| Desired Charactoristics: | Market leader in a defensible niche with defined technology risk |

| Sustainable points of differentiation or regional density with coveted assets | |

| Solid diversity along customer, payor, product and service channels | |

| Stable regulatory environment and reimbursement outlook | |

| Defined recurring revenue model | |

| Leading market position or niche with sustainable competitive advantages | |

| Exceptional management team with a meaningful stake in the business | |

| Growth prospects in healthy end markets | |

| Ability to withstand business cycles |

Submit files 24-7 via our secured loan portal.

Quick help whenever you need it.

We’ve collected a few common job aids, templates, forms, and checklists needed when working on a commercial loan.

Because sometimes one size doesn’t fit all, you’ll sometimes notice different formats for duplicate job aids or forms.

Hopefully these will help!

** All materials made available on Kastali Capital’s website are intended for Real Estate Professionals and intended for educational purposes only.

Job Aids

- Borrower Items

- Financial Statements

- Property Type Checklists

- Property Worksheets

- Construction

- SBA

- Misc.

Sometimes an email is best for complex scenarios.